Is it Time to See a Financial Advisor?

Are you managing your money by yourself or preparing for retirement? How do you know when its time to consult a financial or investment advisor?

Outearned Your Financial Strategy?

Has your income suddenly become more complex? Gone are the days of a straightforward salary, plus bonuses and maybe commissions. To get where you are, you’ve taken on more responsibility and achieved higher-level decision-making abilities.

Business Owner Exit Planning

If you’re a business owner who is thinking of stepping back, selling, or retiring, you have a lot to think about. Do you have a clear picture of what your exit strategy looks like? This guide breaks down what you need to know to plan your personal exit strategy. Check it out!

Invest with Your Head, Not with Your Heart

Are you moved by the swings in the stock market, ready to trade at a moments notice? Or are you looking for the hottest stock that will undoubtedly make you thousands of dollars?

Annual and Lifetime Gift Tax Exclusions Primer

As the year-end approaches, it’s essential to start tax and gift planning efforts. There are several nuances to current federal rules when it comes to gift tax exclusions. Here are some of the most notable details you everyone needs to know.

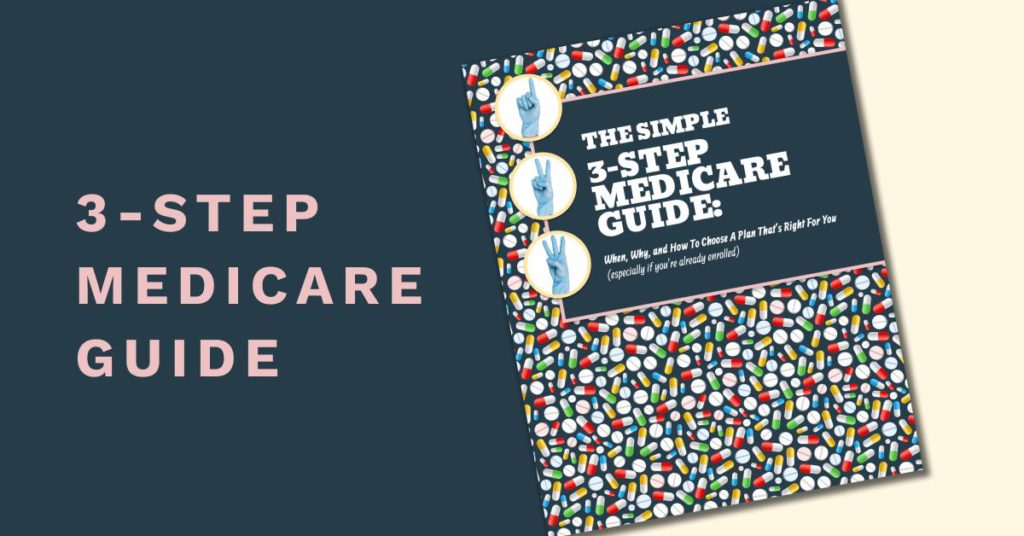

The Simple 3-Step Medicare Guide

Whether you’re looking into Medicare for the first time, or taking advantage of annual enrollment to update your strategy, we’ve broken down the critical choices you must make into a simple decision-making tool

Do You Know What Constitutes Your Credit Score?

Are you bewildered by your credit score? Are you wondering how to increase your score or why your score has taken a nosedive?

Prospects for Investing in the 2020s

The third decade of the 21st century started with a strong economy, record low unemployment levels, and benign inflation. But late in the first quarter over the span of two weeks, investors faced the fastest stock market correction in history.

What Should You Do With An Old 401(k)?

If you are considering a job change in the future or have already made the transition, you may be wondering, “What should I do with my old 401k”? You have several options to consider – cash it out, let it be, or roll it over into your new plan or an IRA. There are benefits and drawbacks of each to consider.

Advisor Q&A: How to Guide to Tax Optimized Investing

In the complex landscape of financial planning, mastering the art of tax-efficient investing is crucial for optimizing wealth accumulation and achieving long-term financial goals. This comprehensive guide, ‘Advisor Q&A: Tax-Efficient Investing,’ brings together expert insights and actionable advice.

Economic Correlation Cyclical and Non-Cyclical Stocks

When the U.S. experiences robust economic growth, specific stock market sectors tend to rise while others hold steady or even decline by comparison. The stocks of companies that experience higher revenues are typically categorized as cyclical.

Top Ten Financial Planning Tips for Business Owners

If you are a business owner this is a must read. Some very important tips on how to think about your future and your business.

End of Year Financial Checkup

The end of a fiscal year brings many opportunities to reflect on our financial objectives, our financial blunders, and our financial accomplishments for the year. Think back to the goals you set for yourself at the beginning of the year. Did you get where you wanted to? If not, why? If so, congratulations! Let’s rinse and repeat!

Give Smarter & Make a Greater Impact with Philanthropy

What inspires you to give? Most of us give for the same basic reasons. We want to help others, make a positive difference in the world—and giving feels good. It makes us happy, and it connects us to the causes we care about.

Tax Strategies to Minimize Taxes & Maximize Gains in Oregon

Navigating Oregon’s tax landscape effectively is crucial for preserving and growing your wealth. Whether you’re managing investment income, equity compensation, or planning for retirement, implementing strategic tax-saving techniques can significantly impact your financial future.

Brokers vs. Advisors: What’s the Difference?

While brokers and advisors may fill similar roles in a client’s life, the services they offer and fees they charge can vary greatly.

Primer to Gross Domestic Product

The economic indicator known as Gross Domestic Product (GDP) represents the dollar value of all purchased goods and services over one year. It is comprised of purchases from all private and public consumption, including for-profit, nonprofit, and government sectors.

Borrowing From Your Retirement Plan: New CARES Act Rules

In late March, Congress passed the Coronavirus Aid, Relief and Economic Security Act (CARES Act). This bill offered provisions related to distributions from retirement accounts.

6 Small Business Retirement Plans

Like almost everything else, setting up a retirement savings plan falls on the shoulders of a small business owner. The plan you chose depends on your business’s size, how it’s structured, and how much money you think you can afford to put aside.

Opportunities Opened Up By New TAX Rules

The Tax Cut and Jobs Act (TCJA), passed at the end of 2017, and SECURE (Setting Every Community Up for Retirement Enhancement) Act, passed at the end of 2019, radically changed your tax picture.1 Most Americans are going to pay less in taxes under the new tax brackets, and a few are going to use this great opportunity to permanently lower the taxes they pay.