< back to Market Insights Blog

Here is some great in-depth research done by one of our fund providers!

Fed Chairman Jerome Powell reinforced in his comments that the central bank’s primary goal is to tamp down inflation — which is running at a 40-year high — and that it will do what it takes to bring it closer to target. The central bank chief also talked positively about growth and the labor market. “All signs are that this is a strong economy,” Powell said. “Indeed, one that will be able to flourish … in the face of less accommodative monetary policy.”

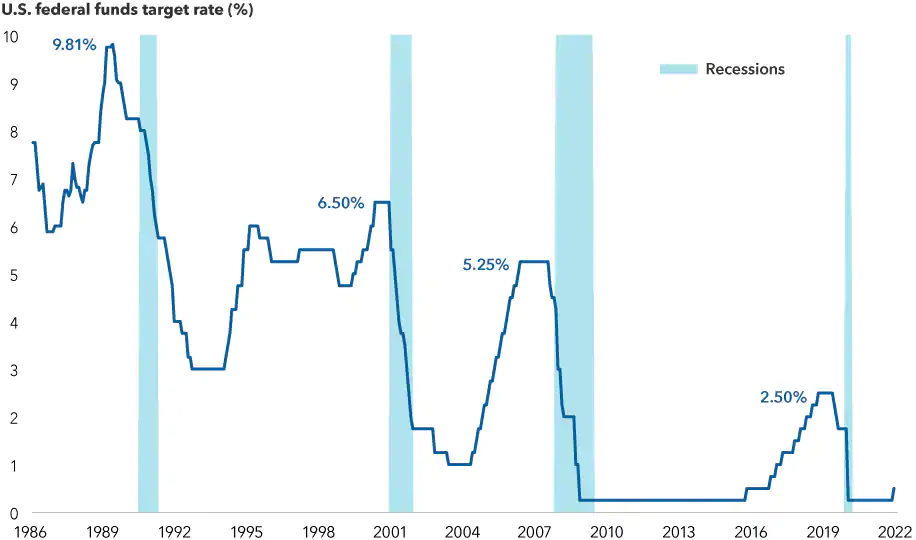

We maintain our view that inflation will remain elevated and that monetary policy is behind the curve. Markets are pricing in about seven 25-basis-point rate increases in 2022. Powell seems confident that the U.S. economy can withstand higher rates, and so barring a major fundamental shock, we expect the Fed will continue on its tightening path for the rest of 2022. He left open the possibility of a 50-basis-point hike but did not specify what might trigger such a move.

Powell emphasized that he wants to see the month-over-month inflation numbers come down. The Fed is increasingly concerned about inflation becoming unmanageable, and its latest projections indicate it may move rates above its estimated long-term neutral rate of 2.4% by next year. The neutral rate is a theoretical federal funds rate at which monetary policy is considered neither accommodative nor restrictive.

Consistent with this view, we favor positioning bond portfolios for tighter financial conditions by maintaining a short duration focused on two-year maturities. We expect the Treasury yield curve to flatten further, led by a rise in shorter maturities while long-term interest rates remain in a range.

We also anticipate quantitative tightening (QT) plans could be unveiled in May and begin in June following another rate increase at the Fed’s May meeting. The central bank will likely shrink its balance sheet by not replacing maturing bonds. While actively selling securities is a possibility, it is not its preferred path.

Peak fed funds rate has declined with each successive hiking cycle

Tight labor markets complicate the inflation picture

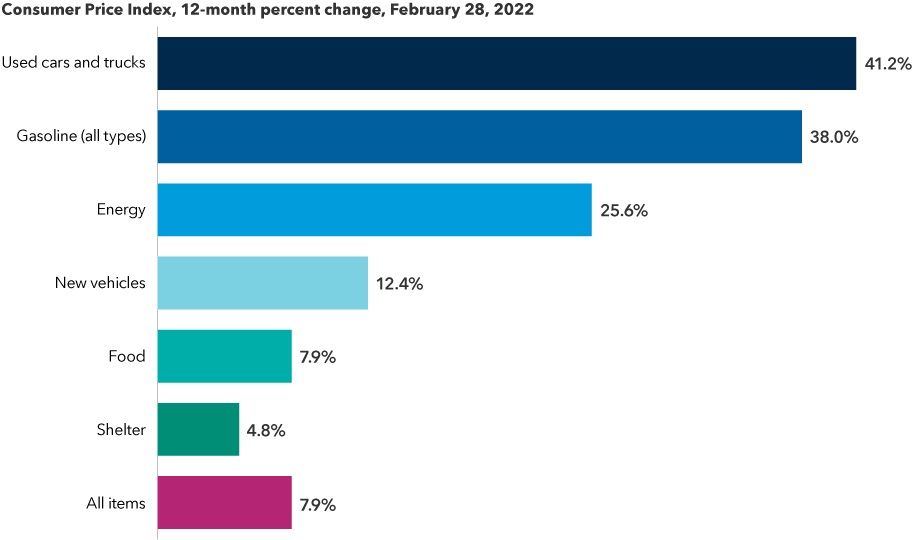

The Fed remains focused on fighting inflation despite a dampened growth outlook given the war in Ukraine. Inflation rose sharply in February with the headline and core metrics accelerating to 7.9% and 6.4% year-over-year, respectively. We continue to see broadening price pressures across major categories, and we see a 50% chance that CPI will accelerate in the coming months. In shelter, the largest component of the Consumer Price Index, prices have increased 4.8% year-over-year, the fastest pace since the early 1990s. Even if you strip out shelter and other high-inflation categories, CPI remains elevated and on an upward trend.

The surge in commodity prices — spanning energy, metals, raw materials and agricultural products — will also feed into inflation. The Bloomberg Commodity Index doubled in the past two years, an increase not seen since the early 1980s. The greatest impact is likely to be felt by lower income consumers as food and gas make up a large percentage of their spending.

Inflation is being driven higher by several components

With supply chain issues likely to remain troublesome and the war creating upside risks to food and energy prices, market participants are pricing rising inflation risk premia (a measure of the premium investors require for the possibility that inflation may rise or fall more than expected over the period in which a bond is held) into bonds. Breakeven inflation on five-year Treasury Inflation-Protected Securities (TIPS) has risen from 3.0% to around 3.5% this year, the highest reading since the launch of the asset class.

Wage growth and a variety of other indicators point to ongoing pressure in the labor market, which Powell said Wednesday had reached an “unhealthy level” of tightness. In February, the U.S. added 678,000 jobs, bringing unemployment down to 3.8%. The labor force participation rate rebounded to 62.3% in February, its highest level since March 2020, indicating there are going to be fewer workers on the sidelines. We are also seeing historically elevated quit rates, signaling that workers have confidence in their ability to find other employment — often with better pay. Average hourly earnings stagnated between January and February but remain up 5.1% over the past 12 months.

We believe the Fed’s most likely plan will be to move steadily toward restrictive policy with consecutive 25-basis-point hikes until policy rates are at or slightly above neutral. However, we are not ruling out the possibility that the central bank will move in a more forceful, Paul Volcker-esque manner. (In 1981, then Fed Chairman Volcker sharply raised rates to contain runaway inflation.)

In terms of societal impact, the Fed faces tough choices. If the Fed remains dovish, allowing inflation to run unchecked, food and energy prices would be among the most likely to accelerate. If it tightens aggressively and stymies growth, unemployment would likely move up and wage increases would be curtailed.

Global overview

The Fed is not alone in its path. Major central banks in Europe have signaled a more hawkish stance in recent weeks as inflation continues to outpace their targets.

The European Central Bank delivered a hawkish message at its March meeting, laying out plans to end its asset purchase program by the third quarter of this year and, in the process, paving the way for a potential rate hike.

Despite the downside risks to growth stemming from the war in Ukraine, ECB President Christine Lagarde focused her remarks on the upside risks to inflation and stressed “optionality and flexibility” in the governing council’s policy stance. The front-end of the euro curve is pricing in roughly 30 basis points of hikes by year-end.

Meanwhile, we expect the Bank of England to deliver another rate increase this week, hiking to 0.75%. This follows the 25-basis-point hike and initiation of passive QT announced in February. All in all, these actions should lead to tighter financial conditions in most of the major developed economies.

Against this backdrop, we maintain a defensive posture in our fixed income portfolios. In U.S. core bond portfolios, in addition to a short duration and positioning for a flattening of the yield curve, we also favor a slight relative underweight to credit. Meanwhile, TIPS prices largely reflect inflationary expectations, so managers are more opportunistic based on where they see value along the maturity spectrum.

In many equity portfolios, depending on investment objectives and mandate, we are starting to see managers selectively add to investments in energy, materials, mining companies, consumer staples and other consumer-related companies with a degree of pricing power.

Ritchie Tuazon is a fixed income portfolio manager with 21 years of industry experience. He holds an MBA from MIT, a master’s in public administration from Harvard and a bachelor’s from the University of California, Berkeley.

Timothy Ng is a fixed income portfolio manager with 16 years of industry experience. He holds a bachelor’s degree with honors in computer science from the University of Waterloo, Ontario.

Thomas Hollenberg is a fixed income portfolio manager with 16 years of industry experience. He holds an MBA in finance from MIT Sloan School of Management and a bachelor’s degree in economics from Boston College.