< back to Market Insights Blog

I hope you’re warm, well, and looking forward to some time with family and friends.

I wanted to drop you a quick email about a couple of things: infrastructure, inflation, and taxes.

And I’ve got a blue-sky question for you at the end. I’m really interested in hearing your thoughts.

President Biden just signed his much-debated bipartisan infrastructure deal.

What does that mean for the economy?

In the short term, some of the infrastructure funding will go immediately toward clearing port and transportation bottlenecks, so that might help improve supply chain issues.1 Fingers crossed.

Though it could be years before you or I drive across a new bridge or highway funded by the bill, some of the maintenance funds could get used in spring construction blitzes.2

Since the job market is already tight, the economy isn’t likely to see an immediate surge in hiring due to infrastructure spending; however, multiple reports suggest ~800,000 new jobs could be added by 2030, though many of them will be temporary rather than long-term jobs.

Economists don’t think inflation is likely to increase due to the slow pace of spending, though the deal is projected to add $256 billion to the federal budget deficit over the next 10 years.

Bottom line, analysts project long-term benefits to the economy in lower business costs, increased labor force participation, and improved competitiveness.3

Inflation might not be as temporary as the Federal Reserve would like it to be.

Prices are up all over, and folks are understandably upset at paying more at the grocery store, gas station, and most everywhere else.

Many analysts hoped that data blips, supply chain clogs, and other pandemic-related disruptions were creating a temporary spike in inflation that would resolve soon.4

However, inflation has remained stubbornly high.

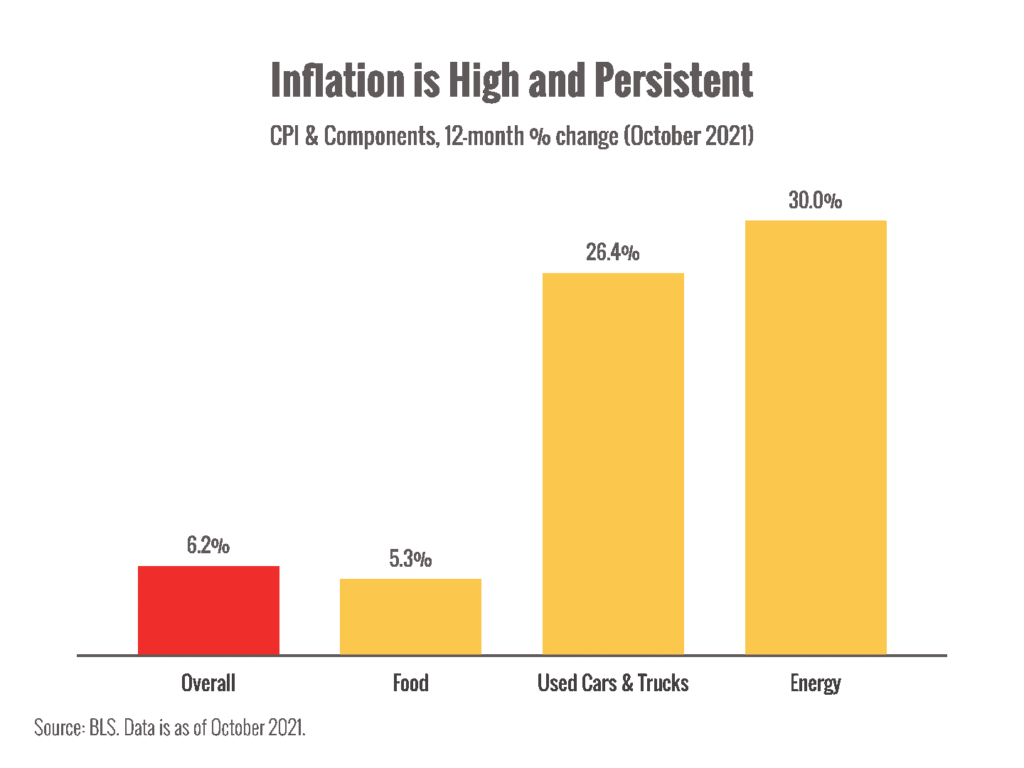

In the U.S., prices have increased 6.2% over the last 12 months — the biggest spike since November 1990. And you can see in the chart that some categories measured by the Consumer Price Index (CPI) have soared by much more.5

Since the Fed’s goal is to keep long-term inflation around 2% (and that’s what we’ve experienced this century), folks are concerned that “temporary” inflation is lingering longer than we want.

So, are prices going to continue to rise in 2022?

That’s likely, but how much, how fast, and for how long depend on a lot of global factors, including whether the Fed raises interest rates or takes other actions.

I’m keeping an eye on it.

Will your taxes go up in 2022?

That’s the question of the month on Capitol Hill as lawmakers debate the Build Back Better deal that could come with tax law changes.

We don’t know when (or if) the bill will be passed, but I’m watching closely and I’ll update you when we know what’s likely to happen.

Before I go, I’d like to wish you and yours a relaxing Thanksgiving with great food, great fun, and great memories.

Gratefully yours,

Goran Ognjenovic

Independent Investment Advisors

(971) 350-8068

www.independentadvisorsnw.com

P.S. It’s the time of year when the analysts start making predictions for 2022. What are your predictions for next year? What will be the big themes? Hit “reply” and let me know your thoughts!

1https://www.washingtonpost.com/us-policy/2021/11/09/biden-supply-chain-ports/

2 https://www.cnn.com/2021/11/09/politics/biden-infrastructure-bill-spending-economy/index.html

4https://www.cnn.com/2021/11/13/economy/what-is-inflation-explainer/index.html

5https://www.bls.gov/news.release/cpi.nr0.htm

This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific situation with a qualified tax professional.

The following posts and commentary are to be used solely as educational tools and do not contain investment advice. Investment advice must be tailored to a particular investor’s specific needs. None of the information contained should be construed to be investment advice. Individuals wishing to tailor a plan to their own needs should seek the help of a Registered Investment Advisor.

There is a high degree of risk in investing and trading. Independent Investment Advisors assumes no responsibility. Principles of Independent Investment Advisors may, at times, maintain directly or indirectly, positions in securities or derivatives mentioned in these comments.