< back to Market Insights Blog

What happens when the predictions are wrong?

Is it time to panic?

Is it time to ditch our strategy?

It’s a fascinating question because it cuts right down to the question of what it means to live in an uncertain world.

Humans are wired to dislike uncertainty.1

And we’re used to a fair amount of (often unwarranted) certainty in the models and paradigms we use to make sense of the world around us.

We’re so attracted to certainty that when economic forecasts and reports come back with “surprises” (also known as being wrong) we tend to freak out.

Especially when the news trumpets every weird bit of data like it’s a huge deal.

Over the last few weeks and months, we’ve had a lot of “surprise” reports.

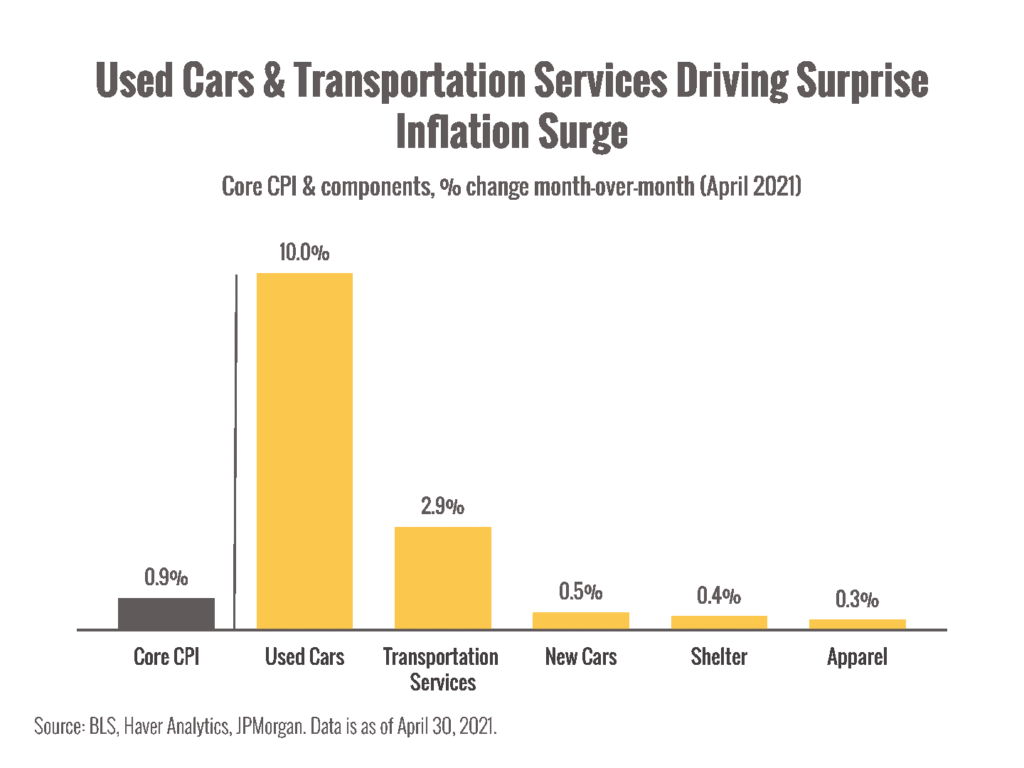

Inflation surprises.

Job market surprises.

Housing market surprises.

Economic growth surprises.

Why are we so surprised?

In a year like 2021, the margin for error is greater than ever.

Predictions, forecasts, and expectations that are based on averages, trends, and other backward-looking methods are ill-equipped to handle the outliers and oddities of a year that’s unlike anything that has come before.

When in history has an entire global economy simply come to a halt?

And then arthritically restarted with many creaks and groans.

To my knowledge, it’s never happened before.

Of course the data is going to have surprises.

We’re probably going to get a lot of things wrong.

I can’t wait for the best-sellers written about all the ways we could have done things better.

So. What does that mean for you and me?

Crystal balls are out of commission.

Surprise is the order of the day, the week, and the year.

The models haven’t caught up yet (though that’s not stopping anyone from issuing very confident predictions).

So we’re being careful and looking out for the opportunities (as well as the hidden pitfalls) in these uncharted waters.

We’re cultivating patience, gratitude, and our ability to make good decisions with incomplete information.

To staying frosty,

Goran Ognjenovic

Independent Investment Advisors

(971) 350-8068

www.independentadvisorsnw.com

P.S. So many folks are making big life changes. Are you? Anything you’re excited to share? Hit “reply” and let me know.

1https://www.psychologytoday.com/us/blog/the-right-mindset/202002/why-uncertainty-freaks-you-out

Risk Disclosure: Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Past performance does not guarantee future results.

This material is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. The content is developed from sources believed to be providing accurate information; no warranty, expressed or implied, is made regarding accuracy, adequacy, completeness, legality, reliability or usefulness of any information. Consult your financial professional before making any investment decision. For illustrative use only.

The following posts and commentary are to be used solely as educational tools and do not contain investment advice. Investment advice must be tailored to a particular investor’s specific needs. None of the information contained should be construed to be investment advice. Individuals wishing to tailor a plan to their own needs should seek the help of a Registered Investment Advisor.

There is a high degree of risk in investing and trading. Independent Investment Advisors assumes no responsibility. Principles of Independent Investment Advisors may, at times, maintain directly or indirectly, positions in securities or derivatives mentioned in these comments.